Septiembre 2017. Drewry anuncia del riesgo de concentración de alianzas de transporte marítimo que conlleva a la posibilidad de fletes mas elevados

Following rapid consolidation among container shipping lines, significant rate increases have been seen in recent months and Drewry anticipates that the momentum of higher freight rates will remain as we move towards 2018. The trend of continuous rate decreases is reversing and the market is undergoing structural changes.

For European exporters to Asia, both spot rates and contract rates have increased since the beginning of 2017 (see chart). This coincided with higher European exports to China in particular, with some capacity reductions as most of the Asia-Europe shipping lines moved to the new mega-alliances (THE Alliance and Ocean Alliance) and with the reduction in the number of carriers on this route (post Hanjin bankruptcy).

China-to-North Continent Europe contract and spot freight rates (indexed)

Sources: Drewry Benchmarking Club and Container Freight Rate Insight

Note: Rates are indexed based on spot rate in May 2016 = 100

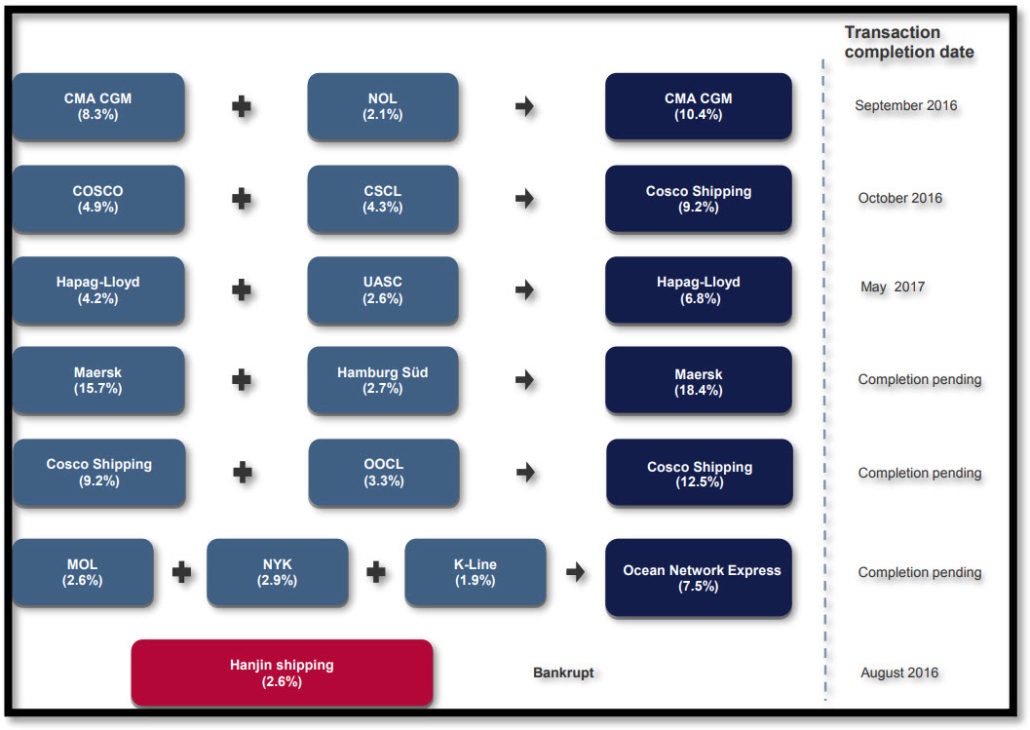

Looking at the short-term outlook for 2018 annual contracts and more widely at the medium term, shippers and forwarders must take into account the fact that, compared with 2 years ago, there will be 8 fewer independent major carriers bidding for tenders (see chart).

Consolidation of the container shipping line sector

Sources: Drewry Supply Chain Advisors, derived from financial announcements

Access to reliable shipper data on market rate levels and using advanced procurement tools with strong optimisation capabilities are two ways that shippers can secure the best terms in challenging market conditions. Drewry can provide support via a contract rate Benchmarking Club, a spot market rate platform (Container Freight Rate Insight) and also an advanced eSourcing Ocean Freight Solution.

Philip Damas, director of Drewry Supply Chain Advisors, described the rush of mergers and acquisitions in the past two years as a “super-cycle” of carrier consolidation. He said: “In effect, we have moved from an industry where we used to talk about the top 20 carriers, to 2018 when there will be just 11 left from this list.”

“This, we suggest, will have very deep repercussions on the entire industry; on shippers, suppliers and terminals,” Damas added. “Also on the level of competition between the carriers, where an industry that is moving, quite frankly, towards an oligopoly, will give carriers much more control than in the past.”

Drewry is a partner of the European Shippers’ Council and would welcome comments or suggestions on these articles.

Exclusive content – Drewry ESC